The course covers the taxation of individuals and of businesses; it addresses the tax practice environment, with tax planning.

“We shall not cease from exploring

And the end of all our exploring

Will be to arrive where we started

And know the place for the first time.”

– T.S. Eliot, Four Quartets

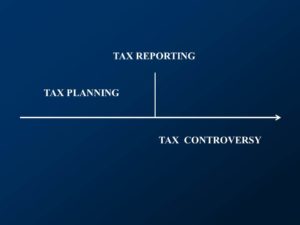

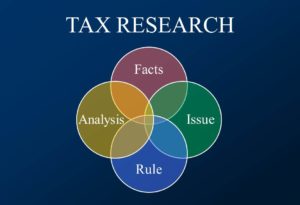

This course is taught from the perspective that students will soon become accounting and tax practitioners; therefore, we first revisit the fundamental topics covered in ACCT371 and ACCT471, apply those topics to tax scenarios by focusing on tax research and tax controversy case study, and then extend our knowledge with new tax topics. Studying tax controversies will facilitate learning tax planning techniques.

The class will:

The class will:

- Discuss taxpayer issues by reviewing court cases that relate to, for example:

- Personal Federal Income Tax:

- Compensation

- Early distributions from retirement plans

- Deferred §1031 exchanges

- Business Federal Income Tax:

- Passivity Activity investments

- Business expense deductions

- Worker classification (Employee v Independent Contractor)

- Hobby activities

- Home office deductions

- Start-up expenses

- R&D tax credits

- Penalty abatement

- Personal Federal Income Tax:

- Engage in outreach to the taxpaying community in Allegany County and Steuben County by their involvement in the Volunteer Income Tax Assistance (VITA) program described below;

- Practice client interviews addressing tax planning and tax controversy issues through role-playing exercises;

- Research tax topics by using industry-standard tax research software;

- Write tax memorandums communicating the results of their tax research;

- Discuss civil tax penalties, and ethical best practices; and,

- Suggest tax planning techniques to limit those potential tax controversies.

Importantly, the class discusses tax policy through the use of exemptions and deductions and other tax preferences. In addition, the class may have access to guest speakers from the accounting and business community that will discuss current relevant tax and business issues (See Events Listing in this Blog).

The CPA Exam:

This course covers certain topics that will be tested in the Regulations (REG) section

Innovate – Engage – Impact

The educational tradition imposes learning from above and from outside – adult standards imposed on those who are slowly growing to maturity within the field. Experiential learning instead holds that “there is an intimate and necessary relationship between the process of actual experience and education.” True learning takes place when doctrine dovetails with those positive experiences that lead to future growth.

TAXATION

LEARNING BY DOING: The Volunteer Income Tax Assistance Program (VITA)

MBA students have an opportunity to directly apply what they learn in class by participating in the Volunteer Income Tax Assistance Program operated by local non-profits where IRS-certified student volunteers provide free basic income tax return preparation with electronic filing to qualified individuals (See Events Listing in this Blog). This is an opportunity to gain valuable experience that employers appreciate, and to also help the community.

MBA students have an opportunity to directly apply what they learn in class by participating in the Volunteer Income Tax Assistance Program operated by local non-profits where IRS-certified student volunteers provide free basic income tax return preparation with electronic filing to qualified individuals (See Events Listing in this Blog). This is an opportunity to gain valuable experience that employers appreciate, and to also help the community.

The university’s VITA efforts were specifically commended in its 2017 AACSB review for engaging students through applied service learning that benefits both students and citizens.

ENTREPRENEURSHIP FINANCE

LEARNING BY DOING: Private Equity & Venture Capital Guest Speakers

MBA students have an opportunity to apply the analytical skills they learn in class as they listen to live “pitch” meetings for businesses in the greentech industry seeking funding (See Events Listings in this Blog).

Recommended Reading:

Recommended Links: