An introduction to the United States tax system, with an emphasis on personal taxation.

“Taxes are what we pay for civilized society.” — Oliver Wendell Holmes, Jr.

The goal of this course is to explain how the federal personal income tax is calculated, discuss tax policy through the use of exemptions and deductions and other tax preferences, and to explain techniques to either legitimately reduce tax amounts owed or to increase tax refunds due.

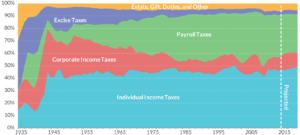

The ocean of taxation is wide and deep with more than 75,000 pages of federal tax codes and regulations, and with supporting seas of revenue rulings and revenue procedures and other tax guidance. And, let’s not forget, the rivers of ever-flowing federal court cases. However, every federal income tax provision supports one or more of the following objectives, that at times work at cross purposes:

- Raise revenue — to pay for the country’s fiscal needs;

- Economic — to stimulate or control the economy;

- Social — to encourage or discourage taxpayer behavior;

- Political — to benefit particular constituents; and,

- Effective tax administration (procedure).

Therefore, there is something for everyone when studying tax:

- Accounting;

- Economics;

- Finance;

- Law;

- Political Science;

- Psychology;

- Sociology; and yes,

- There are even elements of drama.

You will learn to solve tax issues in a team environment by:

- I – Identifying the tax issue(s) to be resolved;

- R – Determining the relevant tax rule(s) under the circumstances;

- A – Analyzing information under the relevant tax rule(s) by gathering and then filtering for relevant facts;

- Using qualitative and quantitative data analysis where appropriate;

- Making ethical and legal decisions based on legal and data analysis, and then extending those decisions to consider their future potential impacts; and,

- C – Communicating the result of your analysis verbally and in writing to stakeholders.

The CPA Exam:

- This course covers certain topics that will be tested in the Regulations (REG) section

Financial Planning (CFP Exam):

- The course also provides future financial planners with some of the basic tax planning tools of their profession.

There may be opportunities to discuss current tax issues with guest speakers (See Events Listing in this Blog)

STAND OUT FROM THE CROWD: ARGUS grant and Independent Study Opportunities

- If a topic particularly interests you, then I will help you apply for an ARGUS grant to research that topic more deeply. Or, maybe an Independent Study is a good option for you.

Innovate – Engage – Impact

The educational tradition imposes learning from above and from outside – adult standards imposed on those who are slowly growing to maturity within the field. Experiential learning instead holds that “there is an intimate and necessary relationship between the process of actual experience and education.” True learning takes place when doctrine dovetails with those positive experiences that lead to future growth.

TAXATION

LEARNING BY DOING: The Volunteer Income Tax Assistance Program (VITA)

The educational tradition imposes learning from above and from outside – adult standards imposed on those who are slowly growing to maturity within the field. Experiential learning instead holds that “there is an intimate and necessary relationship between the process of actual experience and education.” True learning takes place when doctrine dovetails with those positive experiences that lead to future growth.

Students passing ACCT371 have an opportunity to directly apply what they learn in class by participating in the Volunteer Income Tax Assistance (VITA) Program operated by local non-profits where IRS-certified student volunteers provide free basic income tax return preparation with electronic filing to qualified individuals (See Events Listing in this Blog). This is an extraordinary opportunity to gain valuable experience that employers appreciate, and to also help the local community.

The university’s VITA efforts were specifically commended in its 2017 AACSB review for engaging students through applied service learning that benefits both students and citizens.

Recommended Reading:

Recommended Links: