The course covers business taxation, with a focus on partnership taxation.

“Anyone may arrange his affairs so that his taxes shall be as low as possible; he is not bound to choose that pattern which best pays the treasury. There is not even a patriotic duty to increase one’s taxes. Over and over again the Courts have said that there is nothing sinister in so arranging affairs as to keep taxes as low as possible. Everyone does it, rich and poor alike and all do right, for nobody owes any public duty to pay more than the law demands.” – Learned Hand

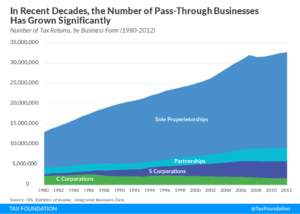

Structure matters.

-

How businesses and business transactions are structured . . . matters.

This course dives into deeper tax waters and builds on ACCT371 by covering the fundamentals of the federal taxation of businesses and business transactions, where you will rightly discover that their structure matters a great deal for tax purposes.

To prepare you for summer internships, we will also:

- Cover basic tax research principles using industry-standard tax research software;

- Write tax memorandums communicating the results of tax research; and,

- Engage in taxpayer role-playing exercises involving tax controversies.

There may be opportunities to discuss current tax and business issues with guest speakers (See Events Listing in this Blog)

- The CPA Exam:

This course covers certain topics that will be tested in the Regulations (REG) section

- STAND OUT FROM THE CROWD: ARGUS grant and Independent Study Opportunities

If a topic particularly interests you, then I will help you apply for an ARGUS grant to research that topic more deeply. Or, maybe an Independent Study is a good option for you.

Innovate – Engage – Impact

The educational tradition imposes learning from above and from outside – adult standards imposed on those who are slowly growing to maturity within the field. Experiential learning instead holds that “there is an intimate and necessary relationship between the process of actual experience and education.” True learning takes place when doctrine dovetails with those positive experiences that lead to future growth.

TAXATION

LEARNING BY DOING: The Volunteer Income Tax Assistance Program (VITA):

The educational tradition imposes learning from above and from outside – adult standards imposed on those who are slowly growing to maturity within the field. Experiential learning instead holds that “there is an intimate and necessary relationship between the process of actual experience and education.” True learning takes place when doctrine dovetails with those positive experiences that lead to future growth.

Students passing ACCT471 have an opportunity to directly apply what they learn in class by participating in the Volunteer Income Tax Assistance Program operated by local non-profits where IRS-certified student volunteers provide free basic income tax return preparation with electronic filing to qualified individuals (See Events Listing in this Blog). This is an opportunity to gain valuable experience that employers appreciate, and to also help the community.

The university’s VITA efforts were specifically commended in its 2017 AACSB review for engaging students through applied service learning that benefits both students and citizens.

Recommended Reading:

Recommended Links: