Mr. Peter White, Senior Tax Counsel at KODAK, spoke to AU students on the topic of International Taxation, focusing on Transfer Pricing. Peter has worked at KODAK for over twenty years, and brings a large range of practical corporate taxation and international business experiences.

Alfred University students practice their drone flight skills thanks to an Appalachian Regional Commission grant and support from Alfred University

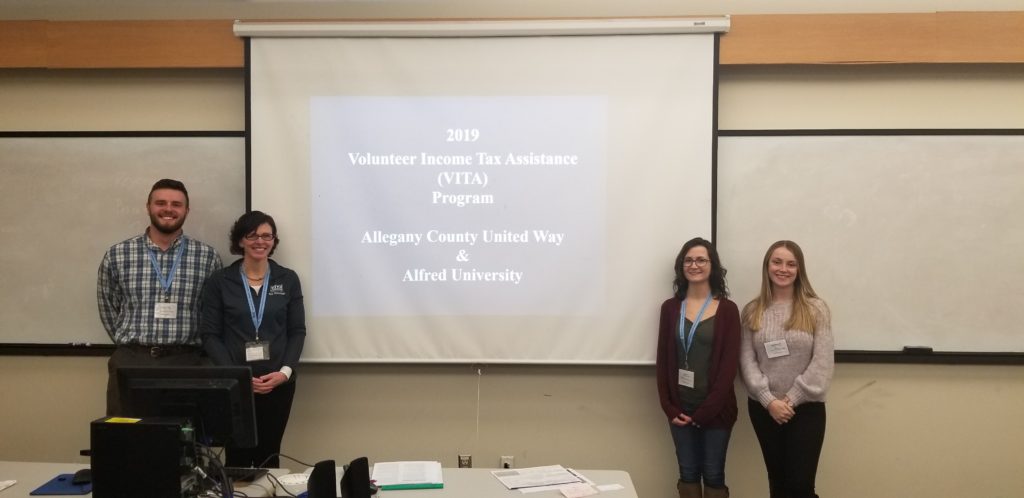

VITA: Allegany County United Way Provided Free Tax Filing Services at Alfred University

Today, Alfred University hosted the Allegany County United Way (ACUW) Volunteer Income Tax Assistance (VITA) program, providing free tax filing services to the local community. Susan Bull, Executive Director of the ACUW, and Mandi Joyce-Phelps, Executive Assistant of the ACUW, and Alfred University Accounting and MBA Accounting Students assisted a taxpayer with their federal and local tax filing needs for this tax season. The Volunteer Income Tax Assistance (VITA) program offers free tax help to people who generally make $66,000 or less, persons with disabilities and limited English speaking taxpayers who need assistance in preparing their own tax returns. IRS-certified volunteers provide free basic income tax return preparation with electronic filing to qualified individuals.

Allegany County United Way supports over 25 nonprofit programs in our community that impact one in every three local residents. For the full list of programs supported, go to their website at www.acuw.com and like them on Facebook.

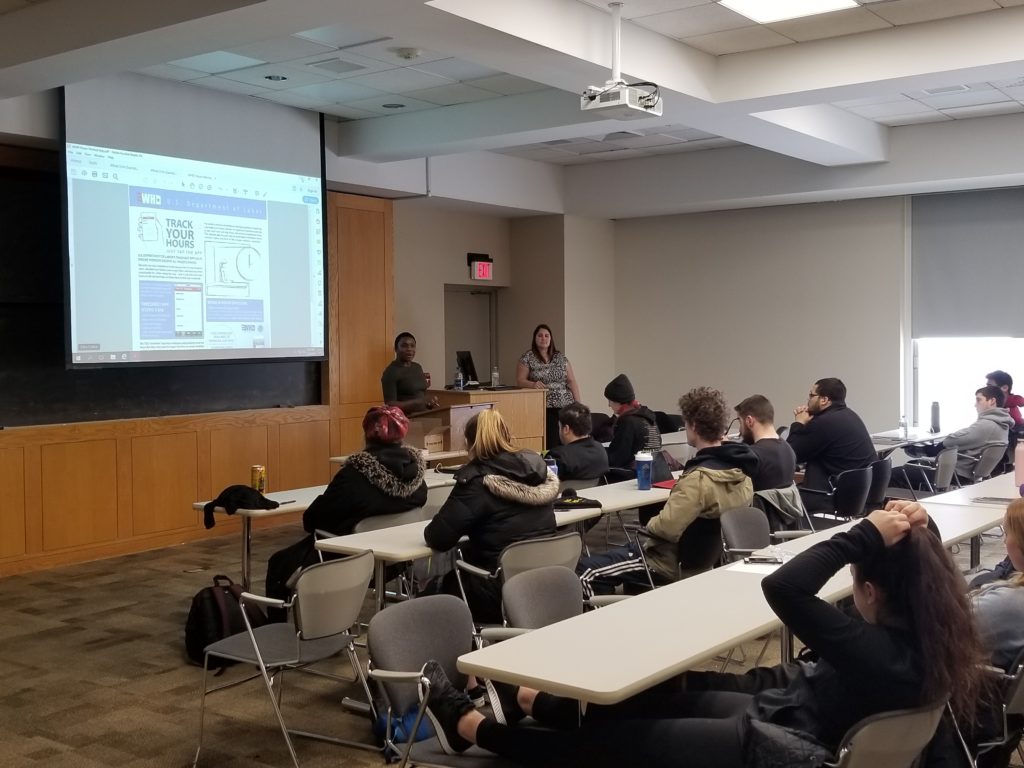

LAW241 Guest Speakers: Mrs. Birdsong and Mrs. O’Dierno of the US Department of Labor

Mrs. Shequeila Birdsong and Mrs. Amber O’Dierno of the US Department of Labor spoke to Alfred University students this morning about Wage and Hour legal issues. They gave many interesting examples of industries that are investigated for non-compliance with federal minimum wage, and other wage and hourly pay requirements.

Mrs. Birdsong is the Community Outreach and Planning Specialist for the Federal Department of Labor’s Wage and Hour Division. She began her federal service with the Internal Revenue Service (IRS) where she spent a decade working in various positions. Her final position at the IRS was as a Taxpayer Advocate.

Ms. O’Dierno is an investigator with the United States Department of Labor’s Wage & Hour Division. She was hired as an investigator in January of 2015. She investigates employers to ensure they are in compliance with federal labor laws including the Fair Labor Standards Act (FLSA), Family and Medical Leave Act (FMLA), Service Contract Act (SCA), Davis Bacon and Related Contract Acts (DBRA), Migrant and Seasonal Agricultural Worker Protection Act (MSPA), and temporary worker programs (H-2A, H-2B, H-1B). Prior to coming to work for the U.S. Department of Labor, she worked as an investigator at the New York State Department of Labor‘s Division of Labor Standards, and the Internal Revenue Service. She has a Master’s Degree in Criminal Justice.

LAW241 Guest Speakers: Mrs. Birdsong and Mrs. O’Dierno of the US Department of Labor

Ms. Shequeila Birdsong and Mrs. Amber O’Dierno of the US Department of Labor spoke to Alfred University students this morning about Wage and Hour legal issues. They gave many interesting examples of industries that are investigated for non-compliance with federal minimum wage, and other wage and hourly pay requirements.

Ms. Birdsong is the Community Outreach and Planning Specialist for the Federal Department of Labor’s Wage and Hour Division. She began her federal service with the Internal Revenue Service (IRS) where she spent a decade working in various positions. Her final position at the IRS was as a Taxpayer Advocate.

Mrs. O’Dierno is an investigator with the United States Department of Labor’s Wage & Hour Division. She was hired as an investigator in January of 2015. She investigates employers to ensure they are in compliance with federal labor laws including the Fair Labor Standards Act (FLSA), Family and Medical Leave Act (FMLA), Service Contract Act (SCA), Davis Bacon and Related Contract Acts (DBRA), Migrant and Seasonal Agricultural Worker Protection Act (MSPA), and temporary worker programs (H-2A, H-2B, H-1B). Prior to coming to work for the U.S. Department of Labor, she worked as an investigator at the New York State Department of Labor‘s Division of Labor Standards, and the Internal Revenue Service. She has a Master’s Degree in Criminal Justice.

LAW241 – Blood Drive

LAW241 student-warriors donated blood to help those in our community. They deserve our many thanks!

Fiat Lux!